Current LocationïžHome - News - Industry

|

|||

| Publishedïž2019.09.01 News SourcesïžQingdao Gute Ship Supplies Co., Ltd. Viewsïž | |||

|

Drop to the lowest in 20 years! Global shipyards have fewer and fewer orders

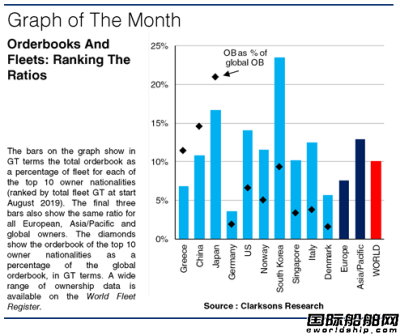

As of early August 2019, global handheld orders accounted for approximately 10% of the existing fleet (GT), a ratio that has created the lowest level in the past 20 years. At the same time, global hand-held orders have fallen by nearly 60% in 10 years, and global hand-held orders have fallen to their lowest level in the past 15 years.

According to a recent report issued by Clarkson, according to Clarksonâs statistics, in the worldâs top 10 shipowners (ranked by the total tonnage of the fleet in early August), Korean shipownersâ orders accounted for the highest proportion of existing fleets. 24%; especially in the container ship sector, Korean shipowners' container ships accounted for 62% of the existing fleet, thanks to the 20 super-large container ships that Hyundai Merchant Marine had ordered in 2018. However, South Korean shipowners hold only 9% of the world's total hand-held orders, ranking fourth in the world.

At the same time, Japanese shipowners hold 17% of the existing fleet, second only to South Korea; however, Japanese shipowners hold the largest share of total global hand-held orders, about 21%. US shipowners hold orders in the current fleet ratio of about 14%, ranking third.

In addition, although the number of orders held by Chinese shipowners in the world's total handheld orders is second only to Japan, up to 15%; but the proportion of orders held by Chinese shipowners in the existing fleet is only 11%.

Among the top 10 shipowners, German shipowners hold the lowest proportion of existing fleets, only 3.6%; in 2008, this ratio was once nearly 60%. Among them, German-owned container ships accounted for less than 1% of the existing fleet, while the figure for 2005 was nearly 70%.

Although the Greek shipowner has the largest fleet in the world and has the world's third largest handheld order volume, Greek shipowners hold only 6.9% of the existing fleet. In recent years, Greek shipowners have been active in the new shipbuilding market for LNG ships. At present, Greek shipownersâ LNG ships hold about 68% of the existing fleet, but their bulk carrier orders account for the current fleet ratio from 2008. 56% fell to only 3%.

By region, in early August 2019, European shipowners' orders for existing fleets were about 8%, lower than the global average; while Asia-Pacific shipowners accounted for more than 13% of existing fleets. At the same time, European shipowners hold 33% of the world's total hand-held orders, and Asia-Pacific shipowners account for 53%. These data show that although the current fleet size of European shipowners (604 million GT) is still larger than the fleet size of the shipowners in the Asia-Pacific region (568 million GT), the gap between the two may be further narrowed in the future.

According to Clarkson statistics, as of August 16, 2019, the global shipyard held orders for 3,202 vessels 79,524,034 CGT. According to CGT, this figure is about 60% lower than in 2009, the lowest since 2004.

According to the latest statistics of Clarkson, the current global fleet size exceeds 1.35 billion GT, of which 57% of the ship's tonnage is controlled by the six major shipowners. The top 10 shipowners are Greece, China, Japan, Germany, USA, Norway, South Korea, Singapore, Italy and Denmark.

|

|||

| This Paper Is Divided Into 1 Page | |||

| Next:Hyundai Heavy Industries receives an order for 174,000 cubic meters of LNG ship | |||

| Previous:The upper shipyard design launches the floating dock in Yangzi Sanjing Shipbuilding | |||