|

Orders went up 12 times! Container ships are leading the new shipbuilding market

Container ship orders increased 12 times compared with the same period last year! New ship orders double year on year! Global orders for new ships have more than doubled in the first five months of this year compared with a year ago, driven by a record wave of orders for container ships, ushering in an unexpected spring in the market for new ships. And Chinese shipping companies are undoubtedly the biggest winner in this round of container ship orders.

New ship orders double, container ship orders record

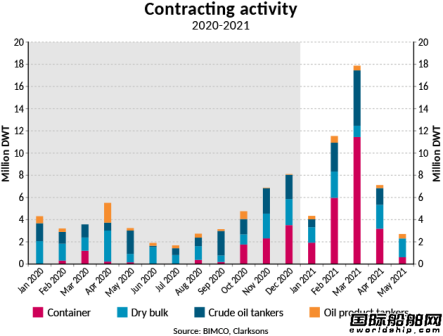

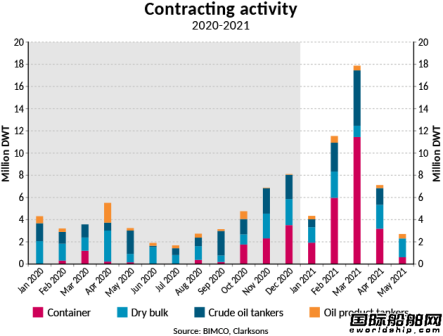

New ship orders so far this year have reached 43.6 million DWT, up 119.7 percent from 19.8 million DWT in the same period in 2020, according to statistics from the Baltic International Shipping Conference (BIMCO). New ship orders for the whole of 2020 were just 49 million DWT, only about 5.5 million DWT higher than the order volume in the first five months of this year.

BIMCO noted that the large rebound in orders had been driven by record orders for container ships, where investors are flush with cash as freight rates have soared at an all-time high. Year-to-date container ship orders have reached 2.2 million TEU, more than 12 times higher than the 1,842,540 TEU recorded in the first five months of 2020 and 60 percent higher than the previous record set in the same period in 2005.

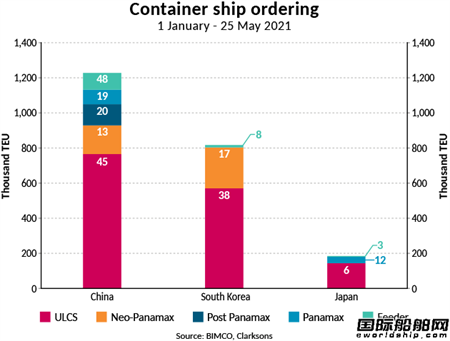

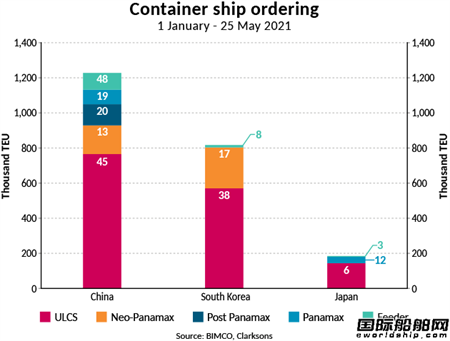

In the first four months of this year, Clarkson data show that global orders for more than 10,000 TEU container ships have exceeded 100. This year's container ship orders are concentrated on very large container ships of 15,000 TEU and above, with a total of 89 vessels with an average capacity of 166,22TEU. BIMCO said there have been no orders for container ships with capacity between 16,000 TEU and 23,000 TEU so far this year, indicating a polarisation of demand between ships with capacity between 15,000 TEU and 16,000 TEU and ships with capacity above 24,000 TEU. A total of 14 new vessels with a capacity of 24,000-24100 TEU have been ordered. More popular are 15,000-16,000 TEU container ships, with 75 orders for a total of 1.1 million TEU.

Orders went up 12 times! Container ships are leading the new shipbuilding market

Orders went up 12 times! Container ships are leading the new shipbuilding market

BIMCO said: "The largest ULCs have proved to be less popular, with congregators viewing 15,000-16,000 TEU vessels as a better option. "This model still offers significant economies of scale and does not impose the same restrictions on flexibility in terms of trade patterns as ships above 20,000 TEU."

The three leading shipbuilding countries, China, Japan and South Korea, have all benefited from the wave of container ship orders. Chinese companies won the most orders, with 145 vessels. South Korean ship companies followed, with 63 ships. Japan is third with a total of 21.

The vast majority of the container ships ordered this year will be delivered in 2023, with a total of 1.5 million TEUs, which would be the highest container ship delivery since 2015.

Demand for crude oil vessels is strong, and owners of bulk carriers are not keen to order new vessels

The bulk carrier market, meanwhile, has also enjoyed a boom and rebounding rates this year, but bulk ship owners do not seem keen to order new vessels. Peter Sand, chief shipping analyst at BIMCO, said bulk ship owners were more likely to buy second-hand vessels.

New orders for bulk carriers this year total 8.6m dead weight tonnes, up just 3.6 per cent from a year earlier, according to BIMCO. Orders for Panamax and Capesize bulk carriers were up 40.9 per cent year on year, but orders for convenience and convenience carriers were down 56.5 per cent year on year.

In the oil tanker market, crude oil tanker orders continued to be strong demand, in the first five months of this year, the number of new vessel orders increased by 47.4% year on year. Mr Sand explained that the increase in crude oil tanker orders was due to tanker owners, who profited well at the peak of the market last year, betting that the market would improve once new vessels were delivered.

While the crude oil tanker market has performed poorly this year compared to the start of 2020, VLCC new vessel orders have increased 125% in the first five months of the year to 8.2 million DWT and 27 vessels from 12, compared with just four vessels of 1.1 million DWT in the same period in 2020.

The surge in orders for VLCC has made up for a decline in orders for smaller tankers. Orders for Avra and Suez tankers in the first five months of the year fell 44.5 per cent year on year to 1.5m DWT.

In contrast to the hot market for new crude oil ships, refined oil ship orders are still at a low level, and new ship orders are concentrated in the mid-sized ship market. This year, the order volume of MR type refined oil tanker reached 28 ships, 1.4 million DWT, while the order volume of LR2 type oil tanker was only 5 ships, and the order volume of LR1 type oil tanker was only 1 ship.

|