|

В В В Only 92 shipyards take orders? Orders soar shipbuilding industryВ В В В В integration accelerated

В В В В В В

After several years of depression, finally ushered in the new global shipbuilding market broke out in 2021, the new ship orders and price rise significantly, but order concentration is higher and higher, the world only 92 yards successful orders this year, at the same time, further reduce the number of "active shipyard" the integration of the global shipbuilding industry continues to accelerate.

Danish Ship Finance has released its latest review of the global shipping market. The report combines clarkson and Danish Shipbuilding Finance company statistics to calculate vessels of more than 2,000 DWT, and defines a shipyard as active if it has at least one vessel of more than 2,000 DWT on its order book.

The report noted that new ship orders rose significantly this year, driven by container ships and liquefied gas carriers, rising 47 percent to 1388 CGT of 37.8 million CGT in the first nine months, already surpassing the 1360 CGT for the whole of last year. The cost of new ships has risen 12 per cent in the past six months to its highest level since 2008-2009, driven by high orders, limited shipyard capacity and surging steel prices.

В В В В В В В В

While this year's order book for new ships is much better than last year's, overall the current order book is low compared to the size of the fleet. Historically, global orders for new ships have averaged about 4 per cent of the fleet each year, compared with 1.4 per cent today.

Danish Shipbuilding Finance attributed this to uneven growth in orders this year, with container ships and liquefied gas vessels increasing to 470 (7% of the fleet) and 143 (7% of the fleet) respectively, but bulk carriers and tankers not significantly improving.

Overall, a trend in shipbuilding is that orders for new ships are increasingly being taken up by larger ships and fewer yards are receiving orders.

В В В В В В В В

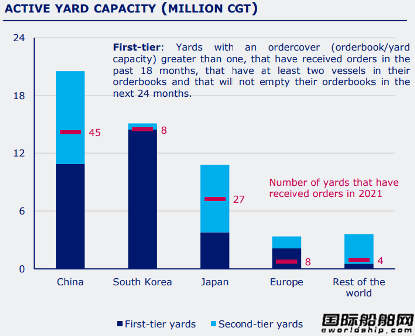

According to the report, global shipyard capacity has decreased by 3.3 million CGT (6%) to 53 million GT in 2021, and the number of active shipyards has decreased from 287 in 2020 to 275, including 107 Chinese, 10 South Korean, 49 Japanese, 49 European and 60 other regions.

The 275 active yards are distributed across 195 different shipbuilding groups, with the top ten (4 in China, 3 in Korea, 1 in Japan, and 2 in Europe) holding approximately 70 per cent of the current global handheld orders, while the remaining 185 have only 30 per cent.

According to the holding order, Danish Shipbuilding Finance company has divided the first and second shipyards into active shipyards. Tier-1 shipyards are those with a holding order/yard capacity greater than 1, which have received orders successfully in the past 18 months, have at least 2 vessels under construction in their existing holding orders and are not expected to empty in the next 24 months. Based on this standard, there are currently 71 first-tier shipyards in the world, significantly higher than 58 in 2020. The 71 first-tier yards represent 60 per cent of global capacity but account for 85 per cent of global hand-held orders, much higher than the remaining 204 second-tier yards.

В В В В В В В

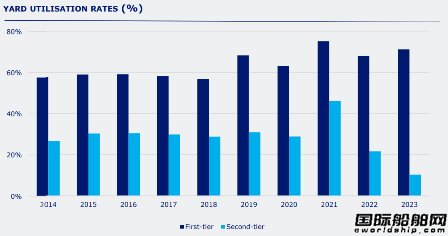

The increase in hand-held orders has greatly increased the workload of first-tier shipyards in the short term, the report said. First-tier shipyard utilization has increased from 63% to 75% in 2021, while second-tier shipyard utilization has increased from 29% to 46%. In the absence of successful orders, 76 yards (4.3 million CGT capacity) will be filled next year, while 164 yards (about 13 million CGT capacity) will be closed from 2023. It also reflects the recent wave of orders concentrated in the big first-tier yards.

Danish Shipbuilding Finance concluded that the outlook for the 2021 shipbuilding market is more positive than last year, but capacity consolidation in the global shipbuilding industry continues despite improving market conditions.

|