|

China is overtaking South Korea in high-technology vessels such as VLGCs and VLGCs

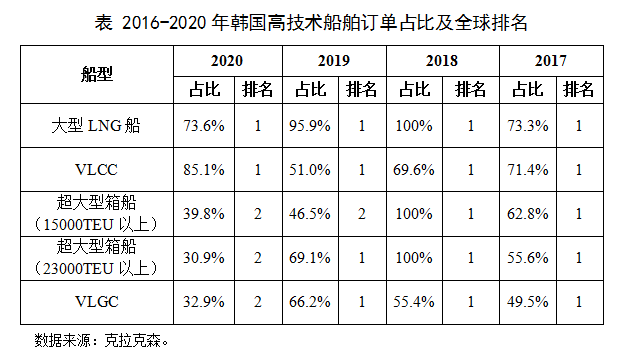

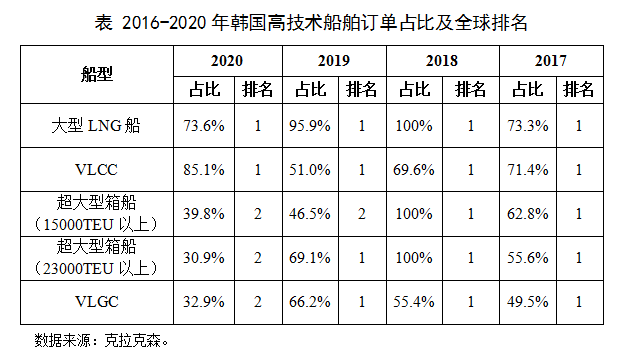

For many years, relying on the technology first-mover advantage, South Korea has long occupied the world's first market share in the field of large LNG carriers, VLCC and other high-tech ships. However, as China continues to make efforts in the field of high-tech ships, since 2019, the market position of some high-end ship types in South Korea has been gradually shaken by China. In 2020, although South Korea's monopoly position in large LNG carriers and VLCC will remain stable, the market share of new orders received by ultra-large container carriers and VLGC will decline significantly and be overtaken by China.

In terms of large LNG carriers, South Korea won 36 out of 49 orders globally in 2020, accounting for 73.6%, still maintaining the first place in the world. In addition, Russia's Red Star Shipyard has acquired 10 ships, and Hudong Zhonghua has acquired 3 ships. Taking into account the factor that Red Star Shipyard is supported by Samsung Heavy Industries, South Korea still occupies an absolute monopoly, accounting for 93.9% of the total. In terms of VLCC, South Korea has received 35 out of 41 orders globally, accounting for 85.1%, also maintaining the first place in the world.

In terms of super large container ships, in 2019, China has surpassed South Korea in the field of more than 15000TEU container ships, and in 2020, China will further surpass South Korea in the field of more than 23000TEU container ships. In 2020, only 8 of the 26 global orders of container ships above 23000TEU were obtained by Daewoo Shipbuilding Ocean, and the rest 18 were obtained by Chinese shipyards, accounting for 69.1% in China. In terms of VLGC, South Korea has also fallen behind China. In 2020, among the 19 new ship orders in the world, South Korea only got 6 ships, while China's Jiangnan Shipbuilding alone got 10 ships. The global market share is as high as 52.5%, nearly 20 percentage points higher than South Korea.

|