|

Top 10 BreakBulk Ship Operators List

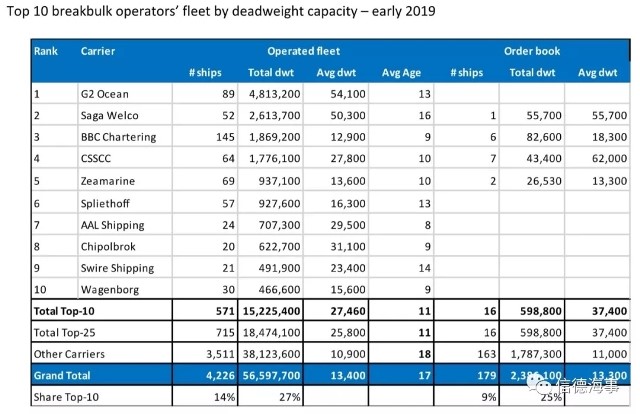

Ship broker Dynamar compiled the top 10 breakbulk operator charts, and G2 Ocean won the first place with its huge pulp fleet.

The Dutch brokerage company compared the multi-purpose ship operator operators based on their fleet's total tonnage to determine which carrier has the largest cargo capacity. as follows

According to the weight of tonnage of the groceries operating shipping company rankings:

The G2 Ocean, which was merged by Gear Bulk and Grieg Star, won the first place due to its large-scale and tonnage open hatch gantry crane pulp fleet. In terms of average tonnage, although the company does not have the largest number of ships, the average tonnage of 54100 DWT makes the company's fleet's total tonnage far ahead.

As shown in the table, the joint venture has 89 vessels with a total deadweight of 4.8 million DWT. Although the company said it has a total of 130 ships, of which 110 are open hatch, the company's fleet consists of only a fleet and a long-term charter fleet.

In any case, the company's fleet is much larger than the second-placed Saga Welco. Saga Welco has a total tonnage of 2.6 million tons and 52 vessels.

Looking down from the third position, breakbulk top 10 shows a more familiar picture: BBC Chartering is ahead of the traditional multi-purpose and heavy-lift shipping company. The company ranked third, with a total tonnage of nearly 1.9 million tons. The company currently operates no fewer than 145 vessels, with an average payload of 12,900dwt, which is significantly different from the average payload of the G2 Ocean fleet of 54,100dwt.

Followed by COSCO Hai Te, Zeamarine, Spliethoff, AAL Shipping, Chipolbrok, Swire Shipping and Wagenborg. The fleets of COSCO Hite, AAL Shipping and hipolbrok are also relatively large, with an average dwt of 27,800. 29,500 and 31,100dwt.

In total, the current multi-purpose fleet consists of 4,700 ships with a total load of 63 million dwt. The fleet can be broadly divided into two categories: ramped (ro/ro) and no ramp.

At present, the order level of new ships is at a fairly low level. The 236 new ship orders are only 5% of the existing fleet. This figure includes all ships that have been delivered and are about to be delivered in 2019.

Of the TOP10, only four companies have new orders. Among them, COSCO Haite has the largest order size, 7 heavy-lift ships, and the average load tonnage has reached 63,000dwt. Subsequently, the BBC had six orders with a total deadweight of approximately 82600 DWT, followed by two 13,300-ton ships from Zeamarine and one from Saga Welco.

As Drewry observed before, Dynamar also noticed the plate, and this type of ship has a tendency to increase its lifting capacity.

Very interestingly, although HMM has only 4 ships, the average lifting capacity of the company's ships has reached 640 tons; followed by Zhongbo's 570 tons; Singapore's AAL's 470 tons; Zeamarine's 395 tons ranked fourth. The BBC's 380 tons ranked fifth. But from the overall lifting capacity, the BBC ranked first and Zeamarine ranked second.

G2 Ocean and Saga Welco are ranked 13th and 16th respectively. In fact, it is not the bigger the ship, the stronger the lifting capacity required for its crane.

|