|

BDI index up ten straight! Higher freight rates may become "new normal" for bulk carrier market

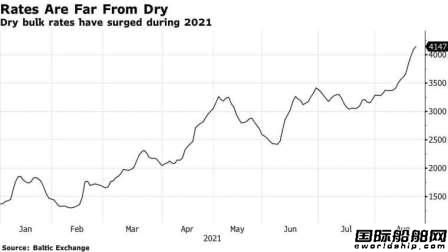

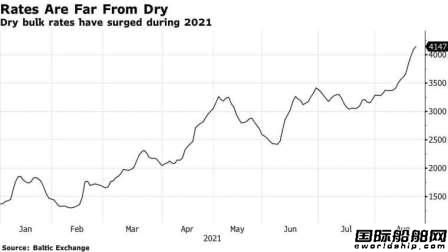

After breaching 4,000 on Friday, the Baltic Dry index was trading at 4,147 on Monday, rising for the tenth consecutive session and setting another 11-year high. Higher freight rates may become the "new normal" in the dry bulk shipping market.

On August 23, the BDI index rose 1.34 percent from the previous month to 4147 points, the highest since May 2010. Among them, the Baltic Capesizes bulk carrier index (BCI) rose 1.95% month-on-month to 6,114 points, a 12-year high, while Capesizes rose 2% to $50,708 a day, the highest level since at least 2014.

Forward prices show that bulk carriers are still bullish. Jan Rindbo, chief executive of D/S Norden, a 150-year-old Danish shipping company that operates more than 500 ships, said: "Earlier this year, the industry thought the surge in rates was just a short-term phenomenon, but now it is starting to see it as more structural and longer-term."

Demand for raw materials such as coal and iron ore has surged this year, far outpacing fleet expansion as the economy recovers from the devastation wrought by the pandemic. The pandemic has further reduced the number of ships available, exacerbating the problem of tight supply of transport capacity, and the market is in favour of shipowners.

Seaborne iron ore trade is expected to rise 4 per cent this year to 1.56bn tonnes, the biggest annual increase since 2017, according to Clarkson's research. Dry bulk trade is forecast to grow by 4.2% annually in 2021 and 1.7% annually in 2022. On the other hand, bulk carrier capacity is expected to grow 3.3 percent this year and 1.4 percent next year, far lagging cargo volume growth.

Iron ore has been a big driver of the dry bulk market's rapid rise this year. George Lazaridis, director of research and evaluation at Allied Shipbroking, believes the bull market still has momentum. Global steel demand remains strong and is expected to remain so until at least 2022. Fewer dry bulk carriers are being built and new orders as a proportion of the fleet are now among the lowest in history. Therefore, the next dry bulk transport market is expected to continue to rise.

Joergen Lian, analyst at DNB Bank, said: "The dry bulk market looks very positive. A recovery has been brewing since last summer and has been accelerated by a pick-up in global trade this year."

Eirik Haavaldsen, shipping analyst at Pareto Securities, said bulk carrier rates are likely to remain firm as long as commodity markets remain strong. The rise will continue for the rest of 2021 as coal imports surge as the northern hemisphere winter approaches.

Joakim Hannisdahl, chief analyst at Cleaves Securities, believes the dry bulk market will remain hot until 2023, given factors such as the new ship construction cycle.

Khalid Hashim, executive director of Precious Shipping, a leading dry bulk Shipping company in Thailand, also believes that the soaring demand for raw materials has not yet reached its peak, and that strict quarantine restrictions at Chinese ports have exacerbated ship delays and reduced effective ship supply due to port congestion. Freight rates will continue to rise.

However, there have been signs of a recent slowdown in bulk carrier trading. In its latest weekly report, Allied said that while dry bulk shipping was still brisk, the market had cooled. Allied Shipbroking said the strong returns in dry bulk shipping are exciting and the market is expected to continue to move higher, but with the global surge in COVID-19, especially the Delta strain, there is still a need to be aware of the risks and the so-called "post-pandemic" era is vulnerable.

Analysts believe that in the uncertain economic trend, should be wary of "excessive investment." Excessive new shipbuilding activity will create new supply and demand imbalances. If the global macroeconomic downturn reduces demand for commodities, increasing investment in future production levels of raw materials will increase price pressures. Therefore, following the crowd is "safe" in the short term, but in the long run must not be cautious.

|